About

Payment Gateway is the system, which mediates and manages all payment requests, that are used to perform different functionalities and operations. To get started, please make sure that you already have an account registered with us and head to Quick Start page.

Quick Start

To jump right into implementation, please head to Authentication Section and later over to API Reference for details of API endpoints.

We also suggest to read Payment Methods section in case you would like information on specific payment methods and their integration. API Reference does not get into very details of each payment method.

You can also refer to Transaction Statuses, Errors as well as Receiving transaction notifications through Postbacks.

Test Data can be found over Appendix.

Authentication

There are two ways of authenticating with our API. We strongly suggest to use BASIC AUTH authentication to speed up the development time. Checksum authentication is considered legacy.

For developers who still use the legacy way of authenticating using checksums, we still provide the documentation below.

Prior to authenticating, make sure to have your API and OUTGOING keys at hand. If you already have an account with us, please navigate to My Company section in your dashboard to view and manage authentication keys.

BASIC AUTH

Basic authentication is a simple authentication scheme built into the HTTP protocol. The client sends HTTP requests with the Authorization header that contains the word Basic followed by a space and a base64-encoded string username:password. For example, to authorize as demo / p@55w0rd the client would send following HTTP HEADER:

Authorization: Basic ZGVtbzpwQDU1dzByZA==

Simply include your API key as your username and OUTGOING key as your password in your basic auth encoding string.

Content-Type Headers

When using BASIC AUTH, you should set your Content-Type HTTP header value to application/json and post a JSON body in your request payloads.

Checksum - (legacy)

To prevent tampering with payment data, the parameters may be signed with a checksum. The outgoing requests are signed with the OUTGOING key. The API applies the following checksum calculation algorithm to verify the authenticity of the posted data.

The merchant is identified and authenticated with API key and a checksum calculated with request parameters and the OUTGOING key. The API, OUTGOING and INCOMING keys should be treated carefully and not revealed to outsiders.

How to calculate checksum?

query_string="api_key=aab1fbbca555e0e70c27¤cy=EUR&merchant_reference=123&order_id=123&payment_type=cc&shipping_costs=3.50&amount=17.50"

outgoing_key="4d422da6fb8e3bb2749a"

# MacOS

echo -n $query_string$outgoing_key | shasum | awk '{print $1}'

# Linux

echo -n $query_string$outgoing_key | sha1sum | awk '{print $1}'

# Please replace the outgoing_key with your own, which is located under the section My Company on your dashboard.

def calculate_checksum(params, outgoing_key)

params_in = {}

params.each do |k, v|

params_in[k] = v || ''

end

Digest::SHA1.hexdigest(URI.encode_www_form(params_in) + outgoing_key)

end

params = [["api_key", "aab1fbbca555e0e70c27"],

["currency", "EUR"],

["merchant_reference", "123"],

["order_id", "123"],

["payment_type", "cc"],

["shipping_costs", "3.50"],

["amount", "17.50"]]

outgoing_key = "4d422da6fb8e3bb2749a"

puts calculate_checksum(params, outgoing_key)

# @returns 9b6b075854fc3473c09700e20e19af3fbc3ff543

# Please replace the outgoing_key with your own, which is located under the section My Company on your dashboard.

function sign_request($params, $outgoing_key){

$query = http_build_query($params, NULL, "&", PHP_QUERY_RFC1738);

$checksum = sha1($query . $outgoing_key);

return $checksum;

}

$params = array(

"api_key" => "aab1fbbca555e0e70c27",

"currency" => "EUR",

"merchant_reference" => "123",

"order_id" => "123",

"payment_type" => "cc",

"shipping_costs" => "3.50",

"amount" => "17.50");

$outgoing_key = "4d422da6fb8e3bb2749a";

printf(sign_request($params, $outgoing_key));

// Return value is 9b6b075854fc3473c09700e20e19af3fbc3ff543

// Please, replace the outgoing_key with your own, which is located under the section My Company on your dashboard.

Please, follow the steps below:

- Make a key/value list of all used parameters (except the checksum itself), in the same order they are posted to the API request

- Convert parameters into a query string using the application/x-www-form-urlencoded format (RFC 1738). See below for more information on how to do the conversion.

- Append the outgoing key to the query string

- Calculate the SHA1 digest of the resulting string

- Set the value of the checksum parameter to the SHA1 digest

We provided checksum calculation code in various programming languages in the sidebar.

Please, keep the following in mind:

- That the order of parameters passed in the request MUST match the order that you have calculated the checksum

- That you have verified your API and Outgoing key

- That you are sending request in correct environment. E.g test vs production.

How to convert parameters into query string?

Spaces are encoded as plus (+) characters and special characters are encoded with a percentage sign followed by two hexadecimal digits. For more details about how to encode a query string see RFC 1738. If the company parameter's key has the value “John & Sons”, {"company": "John & Sons"}, the resulting string will be: company=John+%26+Sons

Where to find credentials?

Credentials such as API, Outgoing and Incoming keys can be found in your Dashboard once you have registered an account with us.

API Reference

Below you will see list of all public API endpoints made available in our Payment Gateway. For each endpoint, we provide example body and response.

Payment API

Payment API is used to create new payments in the Payment Gateway.

Example POST rest/payment payload - Fill in your own API key and return URLs

{

"api_key": "70abd594084787a392e8",

"payment_type": "cc",

"order_id": "122",

"amount": "15.9",

"currency": "EUR",

"address": "WonderStr 8",

"city": "Berlin",

"postal_code": "666",

"country": "DE",

"first_name": "Chuck",

"last_name": "Norris",

"email": "email@email.email",

"postback_url": "https://postback.url.com",

"success_url": "https://success.url.com",

"error_url": "https://error.url.com",

}

Example POST rest/payment response

{

"transaction_id": "5e02903b-0fbf-4266-affd-dc58f2749cd1",

"order_id": "123000",

"error_code": 0,

"status_code": 1,

"status": "started",

"client_action": "redirect",

"action_data": {

"url": "https://some-target-url"

}

}

Payment API Parameters

Payment request parameters are divided into following blocks. Depending on your payment method type, they will differ.

X means that parameter block is accepted for the given payment method and is mandatory.

(X) means that parameter block is accepted for the given payment method and is optional.

| Payment Method | Common Parameters | Billing Address | Shipping Address | Risk Check | Redirection URLs | Recurring | Special Parameters |

|---|---|---|---|---|---|---|---|

| Credit Card | X | X | X | (X) | |||

| SEPA Direct Debit | X | X | (X) | (X) | Sepa Direct Debit Parameters | ||

| SEPA Direct Debit (B2B) | X | X | (X) | (X) | Sepa Direct Debit Parameters | ||

| Purchase on Account | X | X | (X) | (X) | |||

| Purchase on Account (B2B) | X | X | (X) | (X) | Company Details Parameters | ||

| Installments | X | X | (X) | X | X | ||

| giropay | X | X | X | ||||

| Sofort | X | X | X | ||||

| PayPal | X | X | (X) | X | (X) | PayPal Subscriptions Special Parameters | |

| Barzahlen | X | X | |||||

| Paydirekt | X | X | X | ||||

| Request To Pay | X | X | X | ||||

| Advance Payment | X | X | |||||

| iDeal | X | X | X | ||||

| Bancontact | X | X | X | ||||

| MyBank | X | X | X | ||||

| BLIK | X | X | X | ||||

| eps | X | X | X | ||||

| PayU | X | X | X | ||||

| Apple Pay | X | X | Apple Pay Special Parameters | ||||

| Boleto | X | X | Company Details Parameters | ||||

| Boleto B2B | X | X | Company Details Parameters | ||||

| PIX | X | X | |||||

| AiiA | X | X | X | ||||

| SmartPay | X | X |

Common Parameters

The following parameters are used with all payment methods:

| Parameters | Required | Comments |

|---|---|---|

| payment_type | YES | See possible payment types |

| api_key | YES* | Merchant-specific API key (*optional if using Basic Auth) |

| order_id | YES | Any alphanumeric string to identify the Merchant’s order. |

| invoice_id | NO | Any alphanumeric string to provide the invoice number of a Merchant’s order (up to 20 characters) for factoring or debt collection |

| invoice_date | NO | Any date to provide the invoice date of a Merchant’s order for factoring or debt collection. format: “YYYY-MM-DD” |

| customer_id | NO | Any alphanumeric string to provide the customer number of a Merchant’s order (up to 40 characters) for factoring or debt collection |

| merchant _reference | NO | See details about merchant reference |

| amount | YES | Including possible shipping costs and VAT (float number) |

| shipping_costs | NO | Should be set if the order includes any shipping costs (float number) |

| VAT | NO | VAT amount (float number) if known |

| currency | NO | 3-letter currency code (ISO 4217). Defaults to ‘EUR’ |

| postback_url | YES | The URL for updates about transaction status are posted |

| customer_ip | NO | If the order includes a risk check, this field can be set to prevent customers from making multiple order attempts with different personal information. |

| customer_ip_proxy | NO | Like customer_ip, but if the order comes from behind a proxy, this additional field can be used. |

| original_transaction_id | NO | See Original Transaction ID |

| duration | NO | |

| locale | NO | The language of payment forms in Credit Card and Paypal. Possible locale values |

| checksum | NO | A checksum of posted parameters and their values. See Checksum Calculation for a complete explanation. This parameter is optional when you are using BASIC AUTH which we strongly suggest to use. |

| theme | NO | This is the name of the custom theme that can be set for the payment page. This is only for legacy payment page. See Payment Page Theme API for more details. |

| custom_pay_text | NO | If parameter is passed, it will override default Pay Button text in the Credit Card Payment Page |

| additional_transaction_data | NO | Additional payment information provided by you. This will be shown in the dashboard as well as when you query for transaction data. It will also be sent back to your postback_url as part of the postback data. |

Billing Address Parameters

Billing information is required in all payment methods.

| Parameters | Required | Comments |

|---|---|---|

| address | YES | Street address |

| address2 | NO | Second address line |

| city | YES | The town, district or city of the billing address |

| postal_code | YES | The postal code or zip code of the billing address |

| state | NO | The county, state or region of the billing address |

| country | YES | Country Code in ISO 3166-1 |

| first_name | YES | Customer’s first name |

| last_name | YES | Customer’s last name |

| NO* | Customer’s last email. We suggest to provide an email when transaction's payment method type is CC(credit card) to avoid declines in 3DS2. | |

| phone | NO | Customer’s phone number |

Shipping Address Parameters

Shipping address can be specified when it differs from the billing address.

| Parameters | Required | Comments |

|---|---|---|

| shipping_address | YES | Street address |

| shipping_address2 | NO | Second address line |

| shipping_company | NO | Name of the company of the given shipping address |

| shipping_city | YES | The town, district or city of the shipping address |

| shipping_postal_code | YES | The postal code or zip code of the shipping address |

| shipping_state | NO | The county, state or region of the shipping address |

| shipping_country | YES | Country Code in ISO 3166-1 alpha2 |

| shipping_first_name | YES | Customer’s first name |

| shipping_last_name | YES | Customer’s last name |

Company Details Parameters

Company details are required in B2B Purchase on Account and B2B SEPA Direct Debit orders.

| Parameters | Required | Comments |

|---|---|---|

| company | YES | Company name |

| company_vat_id | NO | Starts with ISO 3166-1 alpha2 followed by 2 to 11 characters. See more details about Vat |

| company_trade_register | NO | Company trade registry no |

Risk Check Parameters

If the order includes a Risk Check, the following additional parameters are required:

| Parameters | Required | Comments |

|---|---|---|

| risk_check_approval | YES | This field must be set to 1 for enabling risk checks. |

| date_of_birth | YES | Customer’s date of birth; format: YYYY-MM-DD |

| gender | YES | m for male, f for female, d for diverse |

Redirection URL Parameters

For payment methods that involve browser redirection such as credit card payments, these URLs are required.

| Parameters | Required | Comments |

|---|---|---|

| success_url | YES | Where to redirect the user after a successful transaction |

| error_url | YES | Where to redirect the user after a failed transaction |

The following data is appended to the URL, which is used when redirecting back to the shop’s success or error URLs.

- order_id

- transaction_id

- checksum(optional)

SEPA Direct Debit Parameters

The following additional parameters are required for a direct debit payment.

If the optional sepa_mandate parameter is supplied, the Mandate Reference API request can be skipped prior to making the actual payment request.

| Parameters | Required | Comments |

|---|---|---|

| account_holder | YES | Bank account holder’s name |

| iban | YES | IBAN account number (max. 31 characters) |

| bic | NO | BIC code*(max. 11 characters)* |

| sepa_mandate | NO | Mandate Reference Number (max. 35 characters) |

Recurring Payment Parameters

Some payment methods can use recurring payments. For credit card payments, authorizations can be recurring as well. Here is a summary of the recurring payment flow:

- Create a regular payment with a special parameter: recurring = 1

- Store the transaction_id parameter from the response of the first payment request

- Create any number of repeat payments with the following parameters: recurring = 1 and original_transaction_id = transaction_id from the first transaction

Parameters and flows differ for PayPal Subscriptions. Please follow PayPal Subscriptions section for more information.

For more information about recurring payment see details about recurring and original transaction ID

| Parameters | Required | Comments |

|---|---|---|

| recurring | YES | See recurring |

| original_transaction_id | YES(Except the first time) | See original_transaction_id |

Apple Pay Special Parameters

Request to Payment API with an Apple Pay payment method, requires encrypted apple_pay_token json payload to be passed in.

| Parameters | Required | Comments |

|---|---|---|

| apple_pay_token | YES | Encrypted Apple Pay token in JSON format |

Iframe Parameters

The frame_origin parameter is reserved for complex cases of iframe redirection.

Consider the following scenario: The payment process is started on Website A. Website A embeds an iframe from Website B, which redirects to BP Payment Gateway that hosts the payment form.

Such a redirection will be blocked by browsers unless the BP payment form specifies Website A as an allowed origin in the Content-Security-Policy header. Therefore, regardless of which website initiated the payment request, the frame_origin parameter needs to be set to the protocol and domain of the website that displays the iframe.

For redirection between only two websites, the frame_origin parameter is not necessary.

| Parameters | Required | Comments |

|---|---|---|

| frame_origin | NO | Domain of the page that embeds the payment form in an iframe |

Payment API response

The response includes the following attributes

| Parameters | Comments |

|---|---|

| transaction_id | ID of the created transaction |

| order_id | Order ID of the transaction |

| status_code | Status code of the transaction |

| status | Status of the transaction |

| client_action | Client action such as redirect or postform. When this is not returned, no action required on client side from requester. |

| action_data | Hash that contains URL to redirect on the client side. |

| error_code | Error code for the response |

Authorization API

Example POST rest/authorize payload

{

"api_key": "70abd594084787a392e8",

"payment_type": "cc",

"order_id": "122",

"amount": "15.9",

"currency": "EUR",

"address": "WonderStr 8",

"city": "Berlin",

"postal_code": "666",

"country": "DE",

"first_name": "Chuck",

"last_name": "Norris",

"email": "email@email.email",

"postback_url": "https://postback.url.com",

"success_url": "https://success.url.com",

"error_url": "https://error.url.com",

}

Example POST rest/authorize response

{

"transaction_id": "5e02903b-0fbf-4266-affd-dc58f2749cd1",

"order_id": "123000",

"error_code": 0,

"status_code": 1,

"status": "started",

"client_action": "redirect",

"action_data": {

"url": "https://some-target-url"

}

}

Authorization API is used to create payment authorizations. Authorized payments need to be captured or reversed later on if merchant decides to deduct money from customer's payment authorization or just cancel it by using Reversal API.

Authorization API Parameters

Authorization API parameters are identical with Payment API parameters. Please refer to Payment API for full list of parameters for each payment method.

Authorization API Response

Response is identical to Payment API. Please, refer back for details.

Capture API

Example rest/capture request

{

"transaction_id": "e06dec72-788e-471a-a33f-a9d0deeeb4df",

"api_key": "70abd594084787a392e8",

"amount": 12.4,

}

Example rest/capture response

{

"transaction_id": "e06dec72-788e-471a-a33f-a9d0deeeb4df",

"status_code": 3,

"status": "completed",

"order_id": "123000",

"message": "Request has been processed in test mode",

"card_last_four": "4242",

"card_expiry_year": 2021,

"card_expiry_month": 12,

"card_brand": "VISA",

"error_code": 0

}

Capture API is used to capture amount from previously authorized transactions. It is possible to do partial captures - meaning to capture less that the authorized amount. However, amount may not exceed the original transaction. The result of a successful capture will change the transaction status to complete.

Capture API Parameters

| Parameters | Required | Comments |

|---|---|---|

| api_key | YES* | Merchant API Key (*optional if using Basic Auth) |

| transaction_id | YES | ID of the transaction to be captured |

| amount | NO | In case it differs from the original transaction |

| execution_date | NO | Optional date of the event (YYYY-MM-DD) |

| comment | NO | Optional comment |

| vat | NO | VAT of the captured amount, if known |

| checksum | NO | Checksum of parameters. Legacy, please skip this parameter. |

Capture API Response

The response includes the following attributes

| Parameters | Comments |

|---|---|

| transaction_id | ID of the captured transaction |

| status_code | Status code of the transaction |

| order_id | Order ID of the transaction |

| message | Any message received from acquirer |

| card_last_four | Last four number of the captured credit card |

| card_expiry_year | Expiry year of the captured credit card |

| card_expiry_month | Expiry month of the captured credit card |

| card_brand | Brand of the credit card |

| error_code | Error code for the response |

Reversal API

Example POST rest/reverse request

{

"transaction_id": "8296188e-dd59-4c58-96da-4981976a8e06",

"api_key": "70abd594084787a392e8",

"amount": 12.4,

}

Example POST rest/reverse response

{

"transaction_id": "8296188e-dd59-4c58-96da-4981976a8e06",

"status_code": 12,

"status": "reversed",

"order_id": "123000",

"message": "Request successfully processed in test mode.",

"error_code": 0

}

Reversal API is used to reverse(cancel) previously authorized transactions. Depending on the acquirer configured for your payment method, it's possible to do partial reversals(reversing less than the full amount).

Reversal API Parameters

| Parameters | Required | Comments |

|---|---|---|

| api_key | YES* | Merchant API Key (*optional if using Basic Auth) |

| transaction_id | YES | ID of the transaction to be reversed |

| amount | NO | In case it differs from the original transaction |

| execution_date | NO | Optional date of the event (YYYY-MM-DD) |

| comment | NO | Optional comment |

| vat | NO | VAT of the captured amount, if known |

| checksum | NO | Checksum of parameters. We strongly suggest to skip this parameter when using BASIC authentication. |

Reversal API Response

The response includes the following attributes

| Parameters | Comments |

|---|---|

| transaction_id | ID of the captured transaction |

| status_code | Status code of the transaction |

| status | Status of the transaction |

| order_id | Order ID of the transaction |

| message | Any message received from acquirer |

| error_code | Error code for the response |

Registrations API

Example POST rest/register payload

{

"api_key": "70abd594084787a392e8",

"payment_type": "cc",

"order_id": "122",

"amount": "15.9",

"currency": "EUR",

"address": "WonderStr 8",

"city": "Berlin",

"postal_code": "666",

"country": "DE",

"first_name": "Chuck",

"last_name": "Norris",

"email": "email@email.email",

"postback_url": "https://postback.url.com",

"success_url": "https://success.url.com",

"error_url": "https://error.url.com",

}

Example POST rest/register response

{

"transaction_id": "6ba6655a-d691-4b9a-b858-bb37de2d235f",

"order_id": "123000",

"error_code": 0,

"status_code": 1,

"status": "started",

"client_action": "redirect",

"action_data": {

"url": "https://some-redirect.url"

}

}

Registrations API is used to register credit card information for use in a future payment. Difference between Authorization API is that the prior does not have an amount to block for future deduction.

Registrations API returns tokenized transaction ID, which is used later on with any amount, to make an actual payment.

Below is the summary of the Registration API's use case.

- Send a POST request to /rest/register.

- Redirect the end user to the returned URL.

- End user inputs credit card data and gets redirected back to Merchant’s shop.

- Transaction status should now be registered. Keep the transaction_id for use in original_transaction_id field in further requests.

- Make a payment request to rest/payment using Payment API. Fill original_transaction_id= with the ID from the register call above in the request body. Set recurring=1 if you intend to make recurring payments.

Registration API Parameters

Registration API parameters are identical to Payment API. Please, refer back for details there.

Registration API Response

Registration API response is identical to Payment API. Please, refer back for details there.

Refund API

Example rest/refund request

{

"transaction_id": "f3ba29ea-5644-4e4b-aacd-8d854ebb3d46",

"api_key": "70abd594084787a392e8"

}

Example rest/refund response

{

"transaction_id": "f3ba29ea-5644-4e4b-aacd-8d854ebb3d46",

"refund_id": "2ce3297b-1bda-4637-9375-ecf224cdefc7",

"status_code": 1,

"status": "successful",

"error_code": 0

}

Refund API is used to refund full or partial amounts of payments that were made by merchants' customers. There can be multiple refunds per transaction, however, the combined sum of refunds should not exceed the total amount of the transaction.

Refund API Parameters

| Parameters | Required | Comments |

|---|---|---|

| api_key | YES* | Merchant API Key (*optional if using Basic Auth) |

| transaction_id | YES | ID of the transaction to be refunded. |

| amount | NO | When not given, full amount will be refunded. Can be smaller but not larger that the original amount. |

| execution_date | NO | Optional date of the event (YYYY-MM-DD) |

| pix_key | NO | Optional. Can be passed to transactions made with Credit Card in Brazil, to process refunds through PIX payment method, instead of natively. |

| pix_key_type | NO | Optional. Can be passed to transactions made with Credit Card in Brazil, to process refunds through PIX payment method, instead of natively. Values can be one of the following: "EMAIL", "CPF", "CNPJ", "EVP", "PHONE", "CHAVE_ALEATORIA" |

| vat | NO | VAT of the captured amount, if known. |

| comment | NO | |

| announcement | NO | May only be used for specific acquirer(Payolution). Set this to "1" to make a refund announcement. |

| checksum | NO | Checksum of parameters. We strongly suggest to skip this parameter when using BASIC authentication. |

Refund API Response

The response includes the following attributes

| Parameters | Comments |

|---|---|

| transaction_id | ID of the refunded transaction |

| refund_id | ID of the created refund object |

| status | Status of the refund |

| status_code | Status code of the refund |

| error_code | Error code for the response |

Refund statuses include - STARTED(0), SUCCESS(1), ERROR(2).

Payout API

Example POST rest/payout payload - for direct debit

{

"payment_type": "dd",

"order_id": "12345",

"api_key": "45320990e1c8467468d6",

"amount": 15.9,

"currency": "EUR",

"merchant_reference": "some reference",

"first_name": "Max",

"last_name": "Mustermann",

"address": "Teststr 5",

"city": "Berlin",

"country": "DE",

"postal_code": "15557",

"iban": "DE89370400440532013000",

"postback_url": "your.endpoint.com"

}

Example POST rest/payout response - for direct debit payout

{

"transaction_id": "0b3c2327-9394-4ab4-be18-6e9d85e652fd",

"status_code": 2,

"status": "pending",

"order_id": 123000,

"iban": "DE89370400440532013000",

"bic": "COBADEFFXXX",

"error_code": 0

}

Payout API is used to create payouts - which is a money transfer between merchant's account to customer's account.

Unlike refunds, payouts do not need previously created payment.

Only specific payment methods support Payouts. Please, check in the payment methods page for more information.

For Credit Card Payouts, either an original transaction that represents payment by the customer should exist, or the customers should be redirected to the payment page where they can enter their credit card details - just like in Payment API flow.

Payout API Request Parameters

| Parameters | Required | Comments |

|---|---|---|

| payment_type | YES | See possible payment types |

| api_key | YES* | Merchant-specific API key (*optional if using Basic Auth) |

| order_id | No | Merchant’s OrderID |

| amount | YES | Amount to be paid out to the customer (float number) |

| currency | YES | 3-letter currency code (ISO 4217). |

| original _transaction_id | NO | optional ID of a previous payment; useful for credit card payouts |

| iban | NO | IBAN account number (required for direct debit) |

| bic | NO | BIC code (required for direct debit) |

| account_holder | NO | Bank account holder’s name (required for direct debit) |

| payout_email | NO* | Required for Pay Pal Payouts. E-mail address of the client who receives the payout |

| merchant _reference | NO | See details about merchant reference |

| address | NO | Street address |

| address2 | NO | Second address line |

| city | NO | The town, district or city of the billing address |

| postal_code | NO | The postal code or zip code of the billing address |

| state | NO | The county, state or region of the billing address |

| country | NO | Country Code in ISO 3166-1 alpha2 |

| first_name | NO | Customer’s first name |

| last_name | NO | Customer’s last name |

| NO | Customer’s last email | |

| phone | NO | Customer’s phone number |

| success_url | NO | The URL to which the end user is returned on success (required for credit card) |

| error_url | NO | The URL to which the end user is returned on error (required for credit card) |

| postback_url | YES | The URL for updates about transaction status are posted |

| checksum | YES | Checksum of parameters. Legacy. We strongly suggest to skip this field when using BASIC AUTH. |

Payout API response parameters

| Parameters | Comments |

|---|---|

| transaction_id | Payment Gateway own transaction ID |

| status_code | Transaction’s status code |

| status | Transaction status in words |

| order_id | Merchant’s order ID |

| iban | Receiver's IBAN |

| bic | Receiver's BIC |

| client_action | In case of credit card payouts, you may receive client action such as to redirect to another url. Flow is same as Payment API |

| error_code | Error code; if this is 0, everything is fine |

| error_message | If the error code is other than 0, the error message will be included here. |

Precheck API

Example POST rest/precheck response - with payment method known

{

"transaction_id":"a98ce7f7-97ea-4417-bdcb-f6f4ecde4149",

"status_code":9,

"status":"registered",

"order_id":"123000",

"message":"PRE_CHECK performed successfully.",

"error_code":0

}

Example POST rest/precheck response - with payment method NOT known

{

"transaction_id":"a98ce7f7-97ea-4417-bdcb-f6f4ecde4149",

"status_code":9,

"status":"registered",

"order_id":"123000",

"message":"PRE_CHECK performed successfully.",

"allowed_payment_methods": ["cc", "dd", "sofort"],

"error_code":0

}

Precheck API is used to run risk checks prior to making the payment. Returned transaction_id from the initial POST request to /rest/precheck should be used as original_transaction_id in the actual payment request when using Payment API right after.

Precheck can be run either for a given payment method, or without it as well. Responses slightly differ as mentioned on the right hand side.

Precheck API Request Parameters

Precheck API accepts same parameters as Payment API. You can omit return urls such as success_url and error_url, as well as order_id, if not known during checkout.

Running Precheck without knowing payment method

If payment method is not known yet during checkout stage, you may run the Precheck API without payment method specified.

In such cases, pass precheck for the value of payment_type parameter in your API request.

Precheck API Response Parameters

Precheck API response parameters are same as Payment API.

See response example on the right sidebar.

You would either receive error on unsuccessful risk check, or successful response otherwise.

Mandate Reference API

Example POST rest/create_mandate_reference payload

{

"payment_type": "dd",

"api_key": "45320990e1c8467468d6"

}

Example POST rest/create_mandate_reference response

{

"transaction_id": "c2a6bf6d-2dd7-4a9c-b4de-2d04347d802b",

"token": "a7678918bfbbfa449cf9ff78446b60a4",

"status_code": 9,

"status": "registered",

"error_code": 0,

"order_id": "123000"

}

// token is your mandate_reference to show to the end user

Mandate Reference API is used to create mandate references. SEPA Direct Debit transactions depend on mandates. Please, see implications of using SEPA Direct Debit.

You can either provide mandate yourself in Payment API(sepa_mandate parameter) calls, or send POST request to /rest/create_mandate_reference endpoint.

Mandates can either be one time or recurring. For recurring SEPA Direct Debit payments, use returned transaction_id as original_transaction_id in your further recurring payments when using Payment API.

Mandate Reference API Request Parameters

| Parameters | Required | Comments |

|---|---|---|

| payment_type | YES | dd for direct debit |

| api_key | YES* | Merchant-specific API key (*optional if using Basic Auth) |

| recurring | NO | 1 in case of recurring mandates |

| first_name | NO | First Name of the customer. |

| last_name | NO | Last Name of the customer. |

| NO | Email of the customer. | |

| address | NO | Street address of the customer. |

| address2 | NO | Additional address line of the customer. |

| city | NO | City of the customer. |

| postal_code | NO | Postal Code of the customer. |

| state | NO | State of the customer. |

| country | NO | Country of the customer. |

| phone | NO | Phone Number of the customer. |

| account_holder | NO | Account Holder of the bank account. |

| iban | NO | IBAN of the bank account. |

| bic | NO | BIC of the bank account. |

Mandate Reference API Response Parameters

| Parameters | Comments |

|---|---|

| transaction_id | Payment Gateway own transaction ID |

| status_code | Transaction’s status code |

| status | Transaction status in words |

| order_id | Merchant’s order ID |

| error_code | Error code; if this is 0, everything is fine |

| error_message | If the error code is other than 0, the error message will be included here. |

| token | Mandate reference token |

Cancellation API

Example POST rest/cancel payload

{

// Must be ID of the transaction that was created to start the subscription.

"transaction_id": "c2a6bf6d-2dd7-4a9c-b4de-2d04347d802b",

"reason": "no reason",

"api_key": "45320990e1c8467468d6"

}

Example POST rest/cancel response

{

"transaction_id": "c2a6bf6d-2dd7-4a9c-b4de-2d04347d802b",

"token": "a7678918bfbbfa449cf9ff78446b60a4",

"status_code": 5,

"status": "canceled",

"paypal_subscription_id": "I-B3452HHDSD",

"paypal_plan_id": "I-DSJA4533BDH",

"error_code": 0,

"order_id": "123000"

}

Cancellation API is used to cancel subscription transactions made in the Payment Gateway. Transaction ID of the transaction that was initially created for registration of the subscription must be passed to stop further transactions.

Cancellation API Request Parameters

| Parameters | Required | Comments |

|---|---|---|

| api_key | YES* | Merchant-specific API key (*optional if using Basic Auth) |

| transaction_id | YES | Transaction ID of the original transaction created for initiation of the subscription |

| reason | NO | Reason for the subscription. Defaults to "NO REASON" |

Cancellation API Response Parameters

| Parameters | Comments |

|---|---|

| transaction_id | Payment Gateway own transaction ID |

| status_code | Transaction’s status code |

| status | Transaction status in words |

| order_id | Merchant’s order ID |

| paypal_subscription_id | ID of the PayPal Subscription |

| paypal_plan_id | ID of the PayPal Plan |

| error_code | Error code; if this is 0, everything is fine |

| error_message | If the error code is other than 0, the error message will be included here. |

| token | Mandate reference token |

Revisal API

Example POST rest/revise request

{

// Must be ID of the transaction that was created to start the subscription.

"transaction_id": "c2a6bf6d-2dd7-4a9c-b4de-2d04347d802b",

"api_key": "45320990e1c8467468d6",

"paypal_plan_id": "P-6UK2193323222643NMFJN66Q",

"paypal_subscription_quantity": "6",

"effective_time": "2021-11-30T20:47:25Z"

}

Example POST rest/revise response

{

"transaction_id": "dbd3ab13-38f3-49da-9e12-47ef445b0b72",

"order_id": "123000",

"error_code": 0,

"status_code": 9,

"status": "registered",

"client_action": "redirect",

"action_data": {

"url": "https://www.sandbox.paypal.com/webapps/billing/subscriptions?ba_token=BA-0M029980WL960863C"

}

}

Revisal API is used to update subscription information on an existing approved subscription transaction using PayPal.

Revisal API Request Parameters

| Parameters | Required | Comments |

|---|---|---|

| api_key | YES* | Merchant-specific API key (*optional if using Basic Auth) |

| transaction_id | YES | Transaction ID of the original transaction created for initiation of the subscription |

| paypal_plan_id | YES | ID of the PayPal Plan |

| paypal_subscription_quantity | NO | Subscription quantity. |

| effective_time | NO | Time for changes to take effect. Defaults to current time. Has to be in this format. E.g 2021-09-29T11:47:25Z |

| shipping_costs | NO | Should be set if the order includes any shipping costs (float number) |

| shipping_address | NO | Street address |

| shipping_address2 | NO | Second address line |

| shipping_company | NO | Name of the company of the given shipping address |

| shipping_city | NO | The town, district or city of the shipping address |

| shipping_postal_code | NO | The postal code or zip code of the shipping address |

| shipping_state | NO | The county, state or region of the shipping address |

| shipping_country | NO | Country Code in ISO 3166-1 alpha2 |

| shipping_first_name | NO | Customer’s first name |

| shipping_last_name | NO | Customer’s last name |

Revisal API Response Parameters

The response includes the following attributes

| Parameters | Comments |

|---|---|

| transaction_id | ID of the created transaction |

| order_id | Order ID of the transaction |

| status_code | Status code of the transaction |

| status | Status of the transaction |

| client_action | Client action such as redirect. When this is not returned, no action required on client side from requester. |

| action_data | Hash that contains URL to redirect on the client side. |

| error_code | Error code for the response |

Payment Method Info API

Example GET rest/payment_info?api_key=your_api_key&payment_type=payment_method response

{

disclaimer: "I agree to the risk check performed by Firma AG. More information on terms and conditions available <a href='http://www.firma.de/terms'>here</a>.",

risk_check: false

}

Some payment methods, particularly the ones that use invoice and risk checks, need end user agreement.

Since the legal disclaimers can vary between payment providers, there is a method to pull the disclaimer texts.

Response will also include information on whether risk checks will be performed with this payment method for the requested merchant.

Payment Method Information Parameters

| Parameters | Required | Comments |

|---|---|---|

| api_key | YES* | Merchant API Key (*optional if using Basic Auth) |

| payment_type | YES | See payment type |

| locale | NO | Optional language flag for disclaimer texts (“de” or “en”). Note that some payment providers only support the German language. |

Payment Method API Response

The response includes the following attributes

| Parameters | Comments |

|---|---|

| disclaimer | Disclaimer text |

| risk_check | Boolean(true or false) indicating whether the risk check is needed or not |

Transactions API

Transactions API is used to view and modify transactions.

List of transactions

Example GET rest/transactions response

[

{

"transaction_id":"4927d679-7695-4a31-a901-e89dcfed3d43",

"created_at":"2016-10-26T16:04:33.901+02:00",

"updated_at":"2016-10-26T16:05:00.897+02:00",

"status_code":2,

"status":"pending",

"amount":612.85,

"currency":"EUR",

"order_id":"145000188",

"recurring": 0,

"sepa_mandate": null,

"parent_id": null,

"payment_method":"kar",

"message": "PRE_AUTH performed successfully.",

"sepa_msg_id": null,

"captured_amount": null

},

{

"transaction_id": "07c8b0a4-186f-4b56-a929-17d13b29c695",

"created_at": "2016-10-26T16:03:06.394+02:00",

"updated_at": "2016-10-26T16:03:06.416+02:00",

"status_code": 9,

"status": "registered",

"amount": 0.0,

"currency": "EUR",

"order_id":null,

"recurring": 0,

"sepa_mandate": null,

"parent_id": null,

"payment_method": "dd",

"message": null,

"sepa_msg_id": null,

"captured_amount": null

}

]

Returns list of transactions for the merchant. By default, it will respond with 50 transactions. You can use query parameters to adjust the time-frame to get list of transactions for the given period.

Query parameters for listing transactions

| Parameters | Required | Comments |

|---|---|---|

| api_key | YES* | Merchant-specific API key (*optional if using Basic Auth) |

| from | NO | Optional earliest date in ISO-8601, e.g. 2016-10-05T17:50:28+02:00 |

| to | NO | Optional latest date in ISO-8601, e.g. 2016-10-05T18:50:28+02:00 |

| status | NO | Optional status code or a comma-separated list of status codes, e.g. status=3 or status=2,3 |

| currency | NO | Optional 3-letter currency code (ISO 4217) |

| checksum | NO | Checksum of parameters. Legacy field, we strongly suggest to skip this field. |

Response parameters for listing transactions

Response will include collection of the json objects. Each object will have following parameters:

| Parameters | Comments |

|---|---|

| transaction_id | ID of the transactions |

| timestamps | created_at and updated_at timestamps |

| status_code | Status code |

| status | Status name |

| amount | amount used in this transaction(float number) |

| parent_id | Transaction ID of the parent, usually available for recurring transactions |

| currency | Code of the currency that have been used |

| order_id | Merchant’s order ID |

| payment_method | (Payment method)(#payment_type) |

| message | Message about the transaction |

| sepa_message_id | Sepa message ID |

| sepa_mandate | Mandate Reference Number (max. 35 characters) |

| captured_amount | Captured amount if exists. |

| additional_transaction_data | Additional data provided by you during payment creation |

Retrieve single transaction

Example GET rest/transactions/07c8b0a4-186f-4b56-a929-17d13b29c695 response

{

"transaction_id": "07c8b0a4-186f-4b56-a929-17d13b29c695",

"created_at": "2016-10-26T16:03:06.394+02:00",

"updated_at": "2016-10-26T16:03:06.416+02:00",

"status_code": 9,

"status": "registered",

"amount": 0.0,

"currency": "EUR",

"order_id":null,

"recurring": 0,

"sepa_mandate": null,

"parent_id": null,

"payment_method": "dd",

"message": null,

"sepa_msg_id": null,

"captured_amount": null

}

Responds with single transaction. Simply append transaction_id to the /rest/transactions/transaction_id endpoint.

Query parameters for retrieving a single transaction

The request should include the following parameters:

| Parameters | Required | Comments |

|---|---|---|

| api_key | YES* | Merchant-specific API key (*optional if using Basic Auth) |

| id | YES | The ID of the requested transaction |

| checksum | NO | Checksum of parameters. Legacy. We strongly suggest to skip this field. |

Response parameters for retrieving a single transaction

Response parameters are identical to the one returned from List of Transactions.

Get event logs

Example GET rest/transactions/123/log response

[

{

"created_at": "2021-04-15T11:51:41.793+02:00",

"type": "precheck",

"status": 1,

"amount": 0,

"execution_date": null,

"message": "Risk checks waived: no checkout flows defined."

},

{

"created_at": "2021-04-15T11:51:41.821+02:00",

"type": "authorization",

"status": 2,

"amount": 15.9,

"execution_date": "2021-04-12",

"message": null

},

{

"created_at": "2021-04-15T11:51:42.635+02:00",

"type": "postback",

"status": 2,

"amount": 0,

"execution_date": null,

"message": "Transaction 445 postback completed successfully."

},

{

"created_at": "2021-04-15T11:53:49.405+02:00",

"type": "reauthorization",

"status": 2,

"amount": 20,

"execution_date": "2021-04-15",

"message": "Amount changed"

}

]

Use this endpoint to receive event logs for the requested transaction. Please note that, not all attributes are applicable for all event types. For instance, postback events do not use amount, so the amount is stored as zero.

Execution date is for informative purposes only and can be entered when calling certain invoice operations.(authorize, capture, reverse and refund).

Event log endpoint query parameters

The request should include the following parameters:

| Parameters | Required | Comments |

|---|---|---|

| api_key | YES* | Merchant-specific API key (*optional if using Basic Auth) |

| id | YES | The ID of the requested transaction |

| checksum | NO | Checksum of parameters. Legacy. We strongly recommend to skip this field. |

Get a summary

Example rest/transactions/summary response

{

"count":9,

"total_amount":858.75

}

Use this endpoint when you would like to get a summary of the list of transactions.

Request to this endpoint will return the total sum of transaction amounts and the number of transactions found in the data set.

Query parameters for summary

| Parameters | Required | Comments |

|---|---|---|

| api_key | YES* | Merchant-specific API key (*optional if using Basic Auth) |

| from | NO | Optional earliest date in ISO-8601, e.g. 2016-10-05T17:50:28+02:00 |

| to | NO | Optional latest date in ISO-8601, e.g. 2016-10-05T18:50:28+02:00 |

| status | NO | Optional status code or a comma-separated list of status codes, e.g. status=3 or status=2,3 |

| currency | NO | Optional 3-letter currency code(ISO 4217) |

| checksum | NO | Checksum of parameters. Legacy. We strongly suggest to skip this field. |

Response parameters for summary

| Parameters | Comments |

|---|---|

| count | Number of transactions in the summary. |

| total_amount | Sum of amounts of transactions in the summary. |

Update a transaction

Example POST rest/update_data payload

{

"transaction_id": "0b3c2327-9394-4ab4-be18-6e9d85e650ed",

"invoice_id": "newinvoice-id",

"invoice_date": "01/12/2020"

}

Example POST rest/update_data response

{

"transaction_id":"0b3c2327-9394-4ab4-be18-6e9d85e650ed",

"order_id":"122",

"status_code":2,

"status":"pending",

"error_code":0

}

You can update invoice_id and invoice_date values of any given transaction by sending a POST request to rest/update_data endpoint.

Request Parameters for updating a transaction

| Parameters | Required | Comments |

|---|---|---|

| api_key | YES* | Merchant API Key (*optional if using Basic Auth) |

| transaction_id | YES | Transaction to be updated |

| invoice_id | NO | ID to provide the invoice number of a Merchant’s order |

| invoice_date | NO | Date to provide the invoice date of a Merchant’s order |

| checksum | NO | Checksum of parameters. Legacy field. We strongly suggest to skip this field when using BASIC AUTH |

Response parameters for updating a transaction

| Parameters | Comments |

|---|---|

| transaction_id | Payment Gateway own transaction ID |

| order_id | The order ID specified by the merchant |

| status_code | Transaction’s status code |

| status | Transaction status in words |

| error_code | Error code; if this is 0, everything is fine |

| error_message | If the error code is other than 0, the error message will be included here. |

Submitting transaction to Debt Collection

Some transactions will be sent to debt collection or factoring, under following conditions:

- They have been in pending state for more than 2 weeks.

- Debt Collector has been set up with the merchant.

Exact conditions whether it will be sent to collection or factoring depends on merchant's configuration.

The result is a JSON object of transaction details, just like in the single transaction request. If a debt claim has been successfully submitted, the status will be "debt_collection" or "factoring".

Status Change

Example GET rest/transactions/07c8b0a4-186f-4b56-a929-17d13b29c695/change_status?status=completed response

{

"transaction_id": "07c8b0a4-186f-4b56-a929-17d13b29c695",

"created_at": "2016-10-26T16:03:06.394+02:00",

"updated_at": "2016-10-26T16:03:06.416+02:00",

"status_code": 9,

"status": "completed",

"amount": 0.0,

"currency": "EUR",

"order_id":null,

"recurring": 0,

"sepa_mandate": null,

"parent_id": null,

"payment_method": "dd",

"message": null,

"sepa_msg_id": null,

"captured_amount": null

}

Using this endpoint, you can change the status of the transaction manually. This endpoint is usually used with Invoice transactions that has no automatic way of marking its status completed.

New statuses are limited to the list below in the notice, and it's not possible to change transactions with certain current statuses, such as cancelled, error.

Status Change Request Parameters

| Parameters | Required | Comments |

|---|---|---|

| api_key | YES* | Merchant-specific API key (*optional if using Basic Auth) |

| status | YES | The new status. |

| transaction_id | YES | ID of the transactions |

| debt_collection_id | NO | debt collection ID |

| checksum | NO | Checksum. Legacy. We strongly suggest to skip this field. |

Status Change Response Parameters

| Parameters | Comments |

|---|---|

| transaction_id | ID of the transactions |

| timestamps | created_at and updated_at timestamps |

| status_code | Status code |

| status | Status name |

| amount | amount used in this transaction(float number) |

| parent_id | Transaction ID of the parent, usually available for recurring transactions |

| currency | Code of the currency that have been used |

| order_id | Merchant’s order ID |

| payment_method | (Payment method)(#payment_type) |

| message | Message about the transaction |

| sepa_message_id | Sepa message ID |

| sepa_mandate | Mandate Reference Number (max. 35 characters) |

| captured_amount | Captured amount if exists. |

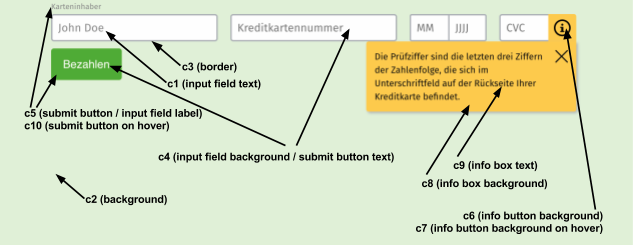

Payment Page Theme API

Using Payment Page Theme API, you can manage your payment page themes. This endpoint is considered legacy and only affects legacy payment page.

The payment page can be customized with a color theme. The parameters of the page are listed in the following table and each parameter can be altered with an API call.

Please note that color values c1 to c10 can be given in hex or rgba color codes. If no value is given for an optional parameter then the default color from the payment page will be used.

Legacy Payment Page Theme Parameters

| Parameters | Required | Comments |

|---|---|---|

| name | YES | Theme name for url path |

| font | NO | CSS fonts |

| c1 | NO | Input field text(hex or rgba) |

| c2 | NO | Background(hex or rgba) |

| c3 | NO | Border(hex or rgba) |

| c4 | NO | Input field background, submit button text(hex or rgba) |

| c5 | NO | Submit button, input field label (hex or rgba) |

| c6 | NO | Info button background (hex or rgba) |

| c7 | NO | Info button background on hover (hex or rgba) |

| c8 | NO | Info box background (hex or rgba) |

| c9 | NO | Info box text (hex or rgba) |

| c10 | NO | Submit button on hover (hex or rgba) |

| checksum | NO | Checksum of parameters. Legacy. We strongly suggest to skip this field when using BASIC AUTH. |

List Merchant Themes

Example GET rest/merchant_themes response

[

{

"id": 17,

"merchant_id": 212,

"name": "My Theme",

"font": "Fira Sans",

"c1": "#868686",

"c2": "#fff",

"c3": "#abb0b6",

"c4": "#fefefe",

"c5": "#59A618",

"c6": "rgba(111, 208, 30, 1)",

"c7": "rgba(255, 204, 0, 1)",

"c8": "#ffc73e",

"c9": "#0a0a0a",

"c10": "#77de20",

"created_at": "2018-02-20T13:29:22.454+01:00",

"updated_at": "2018-02-20T13:29:22.454+01:00"

},

{

"id": 18,

"merchant_id": 212,

"name": "My Theme 2",

"font": "Fira Sans",

"c1": "#868686",

"c2": "#fff",

"c3": "#abb0b6",

"c4": "#fefefe",

"c5": "#59A618",

"c6": "rgba(111, 208, 30, 1)",

"c7": "rgba(255, 204, 0, 1)",

"c8": "#ffc73e",

"c9": "#0a0a0a",

"c10": "#77de20",

"created_at": "2018-02-20T13:29:22.454+01:00",

"updated_at": "2018-02-20T13:29:22.454+01:00"

}

]

Returns list of currently available themes for the given merchant.

Setting up a new theme

Example POST rest/merchant_themes payload

{

"name": "my_new_theme",

"font": "Fira Sans"

}

Example POST rest/merchant_themes response

{

"id":17,

"merchant_id":212,

"name":"my_new_theme",

"font":"Fira Sans",

"c1":"#868686",

"c2":"#fff",

"c3":"#abb0b6",

"c4":"#fefefe",

"c5":"#59A618",

"c6":"rgba(111, 208, 30, 1)",

"c7":"rgba(255, 204, 0, 1)",

"c8":"#ffc73e",

"c9":"#0a0a0a",

"c10":"#77de20",

"created_at":"2018-02-20T13:29:22.454+01:00",

"updated_at":"2018-02-20T13:29:22.454+01:00"

}

Post a payload to rest/merchant_themes endpoint to create a new theme. You may choose to post all parameters which are shown above in the list of Payment Page Theme Parameters.

Update an existing theme

Example PATCH rest/merchant_themes/:theme_id payload

{

"name": "changed_name"

}

Example PATCH rest/merchant_themes/:theme_id response

{

"id":17,

"merchant_id":212,

"name":"changed_name",

"font":"Fira Sans",

"c1":"#868686",

"c2":"#fff",

"c3":"#abb0b6",

"c4":"#fefefe",

"c5":"#59A618",

"c6":"rgba(111, 208, 30, 1)",

"c7":"rgba(255, 204, 0, 1)",

"c8":"#ffc73e",

"c9":"#0a0a0a",

"c10":"#77de20",

"created_at":"2018-02-20T13:29:22.454+01:00",

"updated_at":"2018-02-20T13:29:22.454+01:00"

}

By sending PATCH request to rest/merchant_themes/:theme_id, you can update the existing theme. All parameters mentioned in Payment Page Theme configuration above can be updated.

Viewing an existing theme

By sending GET request to rest/merchant_themes/:theme_id you can get information for the requested theme.

Response is identical to the ones mentioned above.

Jetztzahlen Import API

Example rest/import request

{

"url_name": "test_url",

"batch_name": "any optional note you would like to add",

"invoices": [

{

"debt_claim_number": "123",

"amount": 1.99,

"currency": "EUR",

"print_date": "12.10.2018",

"first_name": "Peter",

"last_name": "Mustermann",

"address": "Egal Str. 1",

"address2": "Complementary str",

"tax_id": null,

"postal_code": "10434",

"city": "Berlin",

"email": "test@testov.com",

"state": "Berlin",

"country":"Deutschland",

"phone": "+49333222111",

"description": "Sport sneakers",

"redirect_after_payments": false,

"success_url": null,

"error_url": null

},

{

"debt_claim_number": "124",

"amount": 1.94,

"currency": "EUR",

"print_date": "2.3.2018",

"first_name": "Petra",

"last_name": "Mustermann",

"address": "Egal Str. 1",

"address2": "Complementary str",

"tax_id": null,

"postal_code": "10434",

"city": "Berlin",

"state": "Berlin",

"email": "test@testov.com",

"country": "Deutschland",

"phone": "+49333222111",

"description": "Sport sneakers",

"redirect_after_payments": false,

"success_url": null,

"error_url": null

}

]

}

Example rest/import response

{

"message": "Invoices have been successfully imported."

}

Jetztzahlen Import API is used to create invoice records for your Jetztzahlen channels.

Import API parameters

| Parameters | Required | Comments |

|---|---|---|

| url_name | YES | url_name of the channel. You can find under channel configurations in the Jetztzahlen Dashboard. |

| batch_name | NO | A reference you would like to add to this batch import. Optional |

| invoices | YES | An array of invoice params as hash. See below for invoice params. |

Invoice params

| Parameters | Required | Comments |

|---|---|---|

| debt_claim_number | YES | Invoice number |

| amount | YES | Amount for the invoice. One EUR and 90 CENTS is represented as 1.90. |

| print_date | YES | Due date for the invoice. DD-MM-YYYY format. |

| currency | NO | Falls back to channel's default currency if not given. 3 letter currency code. ISO-4217. E.g EUR, USD, CHF... |

| first_name | NO | First name of the payee |

| last_name | NO | Last name of the payee |

| address | NO | Address of the payee |

| address2 | NO | Complementary address of the payee |

| tax_id | NO | Tax ID of the payee |

| postal_code | NO | Postal code of the payee |

| city | NO | City of the payee |

| NO | Email of the payee | |

| country | NO | Country of the payee. Full country name either in English or German. |

| phone | NO | Phone number of the payee |

| redirect_after_payments | NO | True or false. Indicating if customers should be redirected to success or error URls after payments |

| success_url | NO | Success URL that customers should be redirected to after payments |

| error_url | NO | Error URL that customers should be redirected to after failed payments |

Jetztzahlen Invoice API

Example GET rest/invoices/fhd-12102020 response

{

"invoice": {

"id": 29235,

"status": "pending",

"created_at": "2019-07-30T22:49:02.081+02:00",

"updated_at": "2019-07-30T22:49:02.081+02:00",

"channel_id": 5,

"merchant_prefix": "test",

"debt_claim_number": "fhd-12102020",

"print_date": "2019-07-02",

"first_name": "",

"last_name": "",

"address": "",

"postal_code": "",

"city": "",

"state": "",

"currency": "EUR",

"import_id": 13,

"amount_cents": 1200,

"description": "",

"address": "",

"address2": "",

"country": "",

"phone": "",

"redirect_after_payments": false,

"success_url": null,

"error_url": null,

"active": true

},

"paylink": "http://yourchannel.jetztzahlen.de/pay/fhd-12102020"

}

Jetztzahlen Invoice API is used to retrieve or delete a specific invoice by its invoice/debt claim number. You can get information such as -- if it's paid or not, active or not, direct payment links and more.

Request parameters

| Parameters | Comments |

|---|---|

| invoice_number | Append invoice number to /rest/invoices/#invoice_number |

Response Parameters

The response includes the following attributes

| Parameters | Comments |

|---|---|

| invoice | Hash containing invoice information |

| paylink | Link that you can send to your customers to open the payment page directly. |

Invoice hash response parameters

Parameters in the invoice hash returned above

| Parameters | Comments |

|---|---|

| ID | ID of the invoice in the system |

| debt_claim_number | Invoice number |

| status | "pending" if unpaid, "paid" if paid |

| timestamps | created_at and updated_at timestamps |

| merchant_prefix | Legacy field, can be ignored. |

| channel_id | ID Channel that invoice belongs to |

| amount_cents | Amount of invoice in cents |

| print_date | Due date for the invoice. DD-MM-YYYY format. |

| currency | 3 letter currency code. |

| first_name | First name of the payee |

| last_name | Last name of the payee |

| address | Address of the payee |

| address2 | Complementary address of the payee |

| postal_code | Postal code of the payee |

| city | City of the payee |

| state | State of the payee |

| Email of the payee | |

| country | Country of the payee. Full country name either in English or German. |

| import_id | ID of the batch Import invoice belongs to |

| active | true or false. If false, invoice will not be available for payment |

| redirect_after_payments | true or false. If true, customers will be redirected to success and error URls |

| success_url | Success URL customers should be redirected to |

| error_url | Error URL customers should be redirected to |

Example PUT / PATCH rest/invoices/fhd-12102020 response

{

"channel_id": 1,

"id": 3,

"first_name": "Max",

"last_name": "Mustermann",

"amount_cents": 1599,

"status": "paid",

"created_at": "2023-04-06T14:47:19.694+02:00",

"updated_at": "2023-05-10T13:42:08.759+02:00",

"merchant_prefix": null,

"debt_claim_number": "888",

"print_date": "2019-07-02",

"address": "Rosenthalerstr. 100",

"postal_code": "12345",

"city": "Berlin",

"import_id": 3,

"description": "Here insert a description",

"country": "Deutschland",

"active": true,

"email": "example@mail.de",

"currency": "EUR",

"state": "Berlin",

"address2": ""

}

Request parameters

| Parameters | Comments |

|---|---|

| invoice_number | Append invoice number to /rest/invoices/#invoice_number |

Response Parameters

The response includes the following attribute

| Parameters | Comments |

|---|---|

| invoice | Hash containing invoice information |

Invoice hash response parameters

Parameters in the invoice hash returned above

| Parameters | Comments |

|---|---|

| ID | ID of the invoice in the system |

| debt_claim_number | Invoice number |

| status | "pending" if unpaid, "paid" if paid |

| timestamps | created_at and updated_at timestamps |

| merchant_prefix | Legacy field, can be ignored. |

| channel_id | ID Channel that invoice belongs to |

| amount_cents | Amount of invoice in cents |

| print_date | Due date for the invoice. DD-MM-YYYY format. |

| currency | 3 letter currency code. |

| first_name | First name of the payee |

| last_name | Last name of the payee |

| Email of the payee | |

| address | Address of the payee |

| address2 | Complementary address of the payee |

| phone | Phone number of the payee |

| postal_code | Postal code of the payee |

| state | State of the payee |

| city | City of the payee |

| state | State of the payee |

| country | Country of the payee. Full country name either in English or German |

| import_id | ID of the batch Import invoice belongs to |

| active | true or false. If false, invoice will not be available for payment |

| description | Description of the invoice |

| redirect_after_payments | true or false. If true, customers will be redirected to success and error URls |

| success_url | Success URL customers should be redirected to |

| error_url | Error URL customers should be redirected to |

This request does not return any response but only response code 204, no content.

Request parameters

| Parameters | Comments |

|---|---|

| invoice_number | Append invoice number to /rest/invoices/#invoice_number |

Response Parameters

The response is empty.

Payment Methods

This section explains usage of different payment methods and their specific details and implications.

Available Payment APIs

Below you can find the list of available actions per each payment method.

| Payment Method | Payment | Refund | Payout | Recurring Payments | Authorize, Capture, Reverse | Precheck | Other |

|---|---|---|---|---|---|---|---|

| Credit Card | X | X | X | X | Register | ||

| Sepa Direct Debit | X | X | X | X | Create Mandate Reference | ||

| Sepa Direct Debit B2B | X | X | X | X | Create Mandate Reference | ||

| Purchase on Account | X | X | X | X | |||

| Purchase on Account (B2B) | X | X | X | X | |||

| Installments | X | X | X | ||||

| giropay | X | X | |||||

| Sofort Überweisung | X | ||||||

| PayPal | X | X | X | X | X | Cancel, Revise | |

| Barzahlen | X | X | |||||

| Paydirekt | X | X | |||||

| Request To Pay | X | X | |||||

| Advance Payment | X | ||||||

| iDeal | X | X | |||||

| Bancontact | X | X | |||||

| MyBank | X | X | |||||

| BLIK | X | X | |||||

| eps | X | X | |||||

| PayU | X | X | |||||

| Apple Pay | X | X | |||||

| Boleto | X | X | Reverse | ||||

| Boleto B2B | X | Reverse | |||||

| PIX | X | X | |||||

| AiiA | X | ||||||

| SmartPay | X |

Credit Card

When integration Credit Card payments with us, merchant's shop/website will need to redirect the customer to the Payment Page that is hosted by us.

Customers proceed to enter their their Credit Card information and then our system will redirect back to your given success or error URLs depending on the outcome of the transaction.

When making the 1st recurring transaction, same redirection flow is expected to be completed. However, further recurring payments will only need a reference to an original(1st) transaction's ID without requiring the merchant's website to redirect any further.

Implementation flow

Example response for credit card with redirect client action

{

"transaction_id": "d1bf9fdf-7268-406f-9e08-8d5a9540ab97",

"order_id": "123000",

"error_code": 0,

"status_code": 1,

"status": "started",

"client_action": "redirect",

"action_data": {

"url": "https://testapi.betterpayment.de/payment/d1bf9fdf-7268-406f-9e08-8d5a9540ab97?custom_pay_text="

}

}

First you make a Payment request.

Response with client_action is returned as shown in the example on the right hand side.

You redirect the client to the payment page url given in action_data.

We redirect back to the merchant's given success, and error URLs.

Running Payment Page in your own website within an Iframe

It's possible to render our payment page within an Iframe, so the customer never have to leave the merchant's shop.

After completing the payment, the web page in the merchant’s success/error URL can include a JavaScript code snippet that breaks out of the Iframe if needed.

3DS2 Requirements

We strongly suggest to provide a complete billing information, specifically following fields when creating Credit Card transactions:

- first_name

- last_name

- address

- city

- postal_code

- country

If you fail to provide these fields, transaction will still successfully be created in our system. However, it's strong possibility that the customer's payment will be declined due to insufficient information that is required by 3DS2 enabled cards and payment method configurations.

SEPA Direct Debit

When implementing SEPA Direct Debit transactions, you first need to see implications of using this payment method.

Once you have familiarized yourself with the implications, you either need to send us sepa_mandate value when using Payment API to create payments OR use Mandate Reference API prior to creating a payment.

SEPA Mandates has to be shown to the customer in the checkout, prior to making the payment, and customer should agree to the collection of the debit amount.

Apple Pay

Apple Pay provides an easy and secure way to make payments in your iOS, iPadOS, and watchOS apps, and on websites in Safari.

Integrating Apple Pay with our Payment API, is possible by passing in the apple_pay_token to us when creating the transaction.

We do not provide payment pages for this payment method, thus, frontend integration should be handled by merchants.

You can check Apple Developer Portal to get information on how to generate Apple Pay tokens, or contact us for more information.

Implementation Flow

Below is the steps to create a successful transaction with Apple Pay.

- Have the button in place in your frontend platform such as web browser, or application screen.

- Prompt the Apple Pay page for the user and let them to authenticate the transaction.

- Receive the encrypted Apple Pay token and pass it in as

apple_pay_tokenparameter in your requests to Payment API - Receive a success or an error response from our API.

Example request body for applepay transaction

{

"api_key": "70abd594084787a392e8",

"payment_type": "applepay",

"order_id": "122",

"amount": "15.9",

// Use JSON.stringify(payment.token["paymentData"])

// when passing this value to our payment gateway.

"apple_pay_token": "your stringified payment token",

"currency": "EUR",

"address": "WonderStr 8",

"city": "Berlin",

"postal_code": "666",

"country": "DE",

"first_name": "Chuck",

"last_name": "Norris",

"email": "email@email.com",

"postback_url": "https://postback.url.com",

"success_url": "https://success.url.com",

"error_url": "https://error.url.com",

}

Example response for applepay transaction request

{

"transaction_id": "d1bf9fdf-7268-406f-9e08-8d5a9540ab97",

"order_id": "122",

"error_code": 0,

"status_code": 3,

"status": "completed",

}

SEPA Direct Debit (B2B)

Same as SEPA Direct Debit, but for B2B clients.

Purchase On Account

Purchase on Account, also known as Invoice or Kauf auf Rechnung in German, offers the possibility to pay the invoice after receiving the goods.

To minimize the possibility of defaults, invoice payments should include a risk check procedure.

If the customer fails to pass the certain risk check flow conditions, an error is returned and transaction is deemed unsuccessful.

In these cases, it's best to offer an alternative payment method.

Purchase on Account (B2B)

Same as Purchase on Account, but for B2B clients.

Installments

Installments payment method is currently available for residents of Germany through Santander Bank. Due amount is credited to merchant's account upon successful authorization and completion of the payment.

Subsequent payments for each monthly installment are triggered automatically by the bank.

Constraints

- This payment method should only displayed for German customers and if the amount is over 99 EUR, unless your account with Santander is contracted with support for lower level amounts.

- Authorized orders should be captured within 90 days of their authorization, otherwise, they will be void.

- Only full captures are permitted.

- Multiple and partial refunds are permitted.

Transaction Flow

When a transaction is created, it will be in started state, waiting for customer action after redirection to Santander's redirect URL.

Once customer completes the application, it will either be declined and customer will be returned to the shop's error URL or it will be pre-approved and state will be pending which the customer will then be redirected to the shop's success URL.

Customer may also cancel the application and redirected to the shop's error URL.

Once transaction is at pending state, shop should wait for postback notifications from payment gateway. Further notifications will move the transaction state from pending to either authorized or declined or canceled depending on the outcome of the loan application.

Once the transaction is at authorized state, merchant is able to either send a request to POST /rest/capture to capture the amount and ship the order, OR send a POST rest/reverse request to cancel/reverse the transaction. Once the transaction is captured, it will reach the completed state. Reversed transactions will reach the reversed state.

Captured transactions in completed state, can be refunded by sending a request to POST rest/refund endpoint.

Giropay

Example POST /rest/payment response for Giropay

{

"transaction_id": "3b5836ae-add6-4ab2-a878-6c9c3a3ffe8d",

"order_id": "123000",

"error_code": 0,

"status_code": 1,

"status": "started",

"client_action": "postform",

"action_data": {

"url": "https://payment.girosolution.de/payment/start",

"fields": {

"urlRedirect": "https://sandboxapi.betterpayment.de/payment_response/9",

"urlNotify": "https://sandboxapi.betterpayment.de/payment_postback/9",

"sourceId": "6da0f976433e18641662198d98557955",

"merchantId": "3606200",

"projectId": "5678",

"amount": "15.9",

"transactionId": "3b5836ae-add6-4ab2-a878-6c9c3a3ffe8d",

"currency": "EUR",

"vwz": "Merchant Name",

"hash": "0e9e4022f143299cc43a91a3fac96f0c"

}

}

}

Giropay is a service offered by GiroSolution that redirects the user to a website where they can complete the transaction by entering their bank account information and login credentials. The user confirms the transaction with their personal TAN code, after which the browser is redirected back to the merchant’s website.

Implementation flow of the Giropay is a little bit different than normal redirection flow seen in Sofort, Credit Card, Paydirekt and PayPal payment methods.

In Giropay, a POST request to /rest/payment will return a client_action which will include form data to submit to given url in the response. Once you submit that form to the given URL, customer will be redirected to the Giropay's payment platform automatically. Once customer completes the payment, they will return to your given success or error URL, depending on the outcome of the transaction.

Sofort (Klarna)

SOFORT Überweisung is an online payment service which is offered by SOFORT AG. Technically it is very similar to Credit Card, PayPal and Paydirekt flow. The user is redirected to a payment site hosted by SOFORT and returns back to the merchant’s site after completing the transaction.

Please note that SOFORT refunds can only be halfway automated. They can be started over the API but must be finalized in SOFORT's dashboard by downloading a transaction file and uploading it to the merchant's bank.

PayPal

PayPal is an online payment service offered by PayPal Inc. It is also very similar to SOFORT. The user is redirected to a payment site hosted by PayPal and returns back to the Merchant's site after completing the transaction.

PayPal Subscriptions

In order to implement recurring payments with PayPal, you will have to implement flows for PayPal Subscriptions.

This, differ from traditional recurring payments.

PayPal takes control over triggering payments unlike traditional recurring payments - where merchant is responsible for triggering each payment after initial billing agreement.

PayPal Subscriptions Pre-requisites

You will have to familiarize yourself with concepts surrounding PayPal Subscriptions.

Follow this documentation guide to learn more about Catalogue Products API, Plan API, and Subscriptions API.